From Transactional to Transformational

Beyond Training: Future-Proof Your Advisory Business

A scalable, sustainable approach to financial advising that helps retain more clients and build market leadership.

The financial advising industry

is changing.

Clients don’t just want someone to manage their money—they want someone who understands their fears, life transitions, and financial goals. Julia supports firms through the process of embedding transformational advising into their business—enabling top advisors to retain clients, acquire new ones, and build a future-proof practice.

This program provides the skillsets, toolsets and mindsets to go beyond traditional advising.

It enables financial advisors with the skills to build deep, meaningful relationships that lead to higher client retention, stronger referrals, and greater trust.

🔹 Master the First Meeting: Ask the right questions, listen actively, and establish trust.

🔹 Understand Client Psychology: Go beyond financial statements—discover what truly matters to clients.

🔹 Retain Clients for Life: Build relationships, especially with female clients (e.g.: after the inherit, after a parent’s passing or a divorce)>

🔹 Adapt to Industry Shifts: Wealth is transferring to women and diverse communities—learn how to serve them effectively.

🔹 Future-Proof Your Practice: Relationship-driven advisors will dominate the next era of wealth management.

Why Traditional Advising

No Longer Works

The old model of financial advising focused on transactions—selling products, managing portfolios, and

maximizing returns.

🔴 Transactional advisors focus on numbers.

🟡 Relational advisors focus on connections.

🟢 Transformational advisors guide clients through life’s financial journey—becoming trusted partners, not just service providers.

✅ This program helps advisors shift from transactional to transformational—unlocking higher client loyalty and long-term success.

Who This Program is For

✔ Wealth management firms looking to improve client retention & satisfaction.

✔ Advisors struggling to retain female clients after a spouse’s passing or divorce.

✔ Firms looking to differentiate in a competitive market.

✔ Leadership teams who see the future of finance as human-first, not product-driven.

👉 If you want to retain more clients, build lasting trust, and create a scalable, relationship-driven practice—this program is for you.

How Julia Works

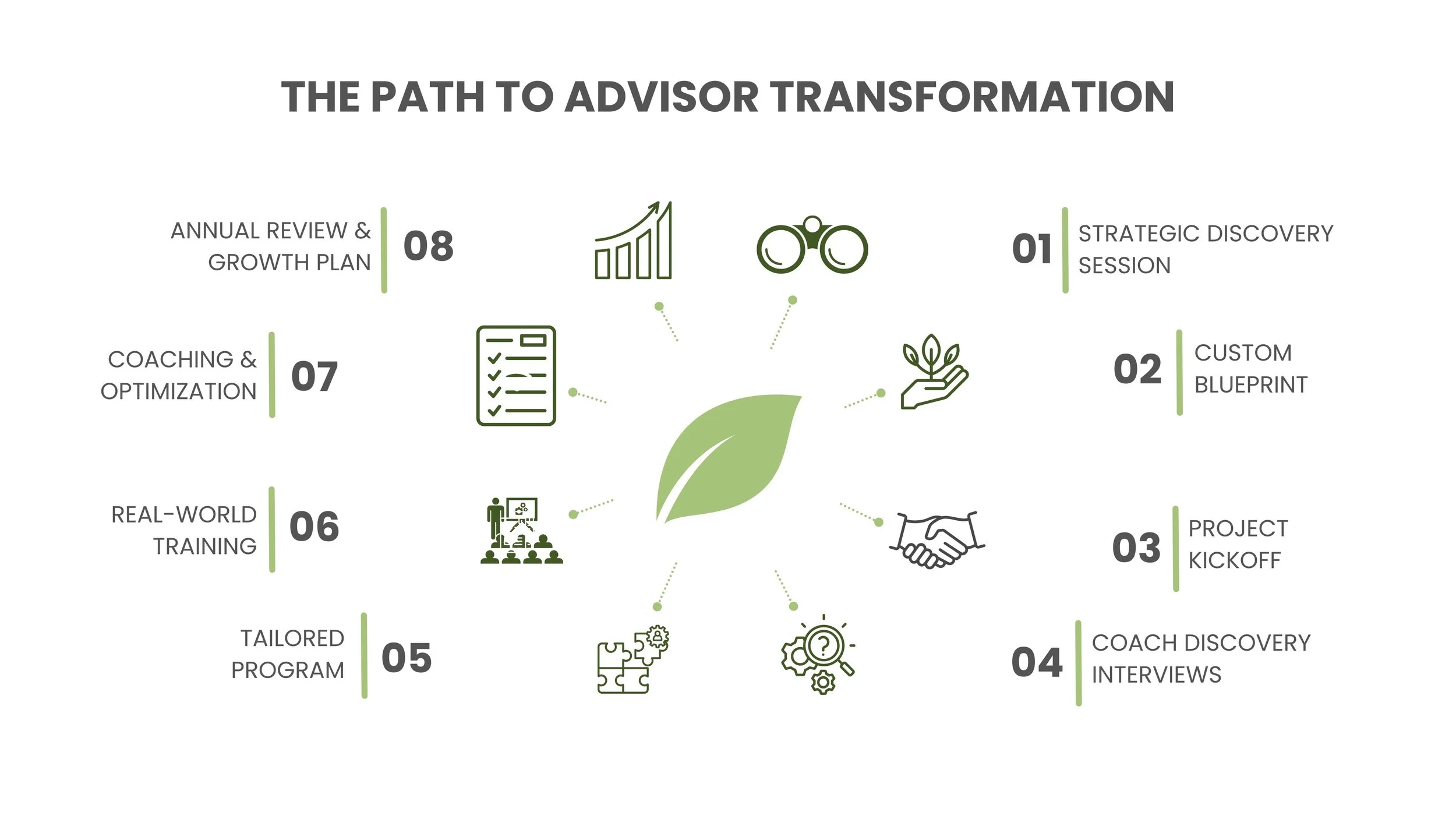

📌 Step 1: Diagnostic & Strategy Development

✅ Identify gaps in advisor communication & trust-building

✅ Develop a tailored plan to integrate transformational advising into your firm

📌 Step 2: Advisor Training & Implementation

✅ Hands-on training in active listening, trust-building, and human-first advising

✅ Case studies, real-world exercises, and interactive coaching

📌 Step 3: Real-World Application & Optimization

✅ Live monthly coaching as advisors integrate their new skills into client meetings

✅ Ongoing feedback and refinement for long-term success

The impact: a firm-wide transformation that keeps clients engaged for life.

The Result? More engaged clients, more referrals, and a more fulfilling practice.

The Business Impact

📈 Higher Client Retention – Clients stay when they feel heard & understood.

📈 Scalability – Train multiple advisors instead of hiring one.

📈 Increased Revenue Stability – Long-term relationships mean long-term profitability.

📈 Future-Proofing – Relationship-driven firms will dominate the industry.

Your firm has a choice—hire one great planner or train

an entire team to be transformational advisors.

Let’s build a sustainable model that keeps clients loyal for life.

“I cannot say enough about the help Julia has given us to get where we want to go. Amazing what you can do with the

right help.”

S. McNally

“Providing this gift to my family does not have a price.”

A. Szocs

“My fiancé and I wanted someone who understood our goals, as well as our relationship to money. I would recommend Julia as a financial advisor who cares deeply about her clients and is always there.”

J. Munro

Start the transformation, today.

Book a strategy call with Julia, using the form below.